Managed Account Assets Growth

Slows to 2.3% in Q4 2024

- MMI-Cerulli Data

The newest edition of MMI-Cerulli Advisory Solutions Quarterly, with data through 12/31/2024, is now available for download.

Managed account growth stagnated in Q4 2024, increasing 2.3% to reach $13.8 trillion in total assets. Despite the slowed growth, industry net flows increased 17.9% from Q3 to reach $252.9 billion. Driven primarily by flows into the wirehouse channel, unified managed account programs ($74.3 billion) led the way in Q4 2024 net flows followed by separate account programs ($64.7 billion). Dual-contract separate account programs (4.9%) experienced the most substantial asset growth in the fourth quarter, followed by ETF Advisory (3.8%) and single-contract SMA (3.8%) programs. Rep as advisor (0.1%) and proprietary separate account (0.3%) programs both exhibited limited growth to close the year.

Model-Delivered and Manager-Traded to Both Play Crucial Roles in the Future of SMA Trading

This edition of Advisory Solutions Quarterly also examines diverging expectations for model-delivered and manager-traded SMAs as wealth management platforms evolve.

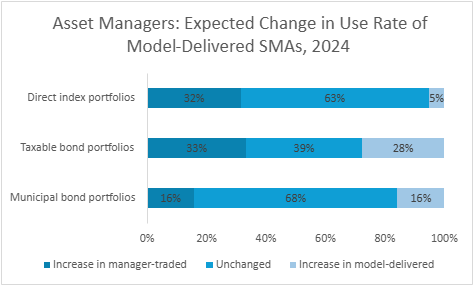

As sponsor firms continue consolidating their managed account platforms, they seek to increase the use of model-delivered separately managed accounts. Asset managers have responded by delivering most SMA asset classes via model, with a few exceptions for more complex strategies (e.g., fixed income, alternatives). However, investments in technology have allowed asset managers to more easily integrate manager-traded SMAs into sponsors’ UMA platforms and better align with firms’ tax management systems.

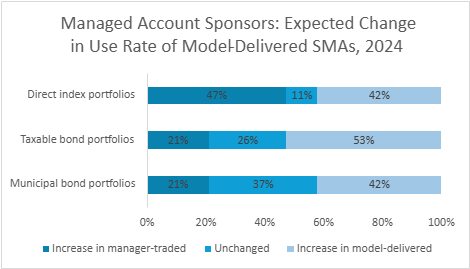

While managed account sponsors and asset managers largely agree that large-cap domestic equity portfolios will experience a rise in model-delivery, 53% of sponsors expect an increase in model-delivered taxable bond portfolios compared to just 28% of asset managers. There is no consensus among sponsors and asset managers regarding the future of SMA portfolio trading; however, both manager-traded and model-delivered SMAs will continue to play critical roles.

of managed-account sponsors expect an increase in model-delivered taxable bond SMAs.

MMI-Cerulli Advisory Solutions Quarterly

The Advisory Solutions Quarterly periodical provides holistic analyses of the U.S. fee-based advisory industry, which includes sponsors (broker/dealer firms) that offer managed account programs and the asset managers that distribute those programs through their platforms.

Dive deeper into the report for insights in four key areas:

- Asset Management Distribution

- Long-Term Managed Accounts Industry Trends

- Top-Managed Account Program Sponsors Across All Industry Segments

- Asset Allocation Model Portfolios

MMI-Cerulli Q4 2024 Advisory Solutions Quarterly Highlights

Joan Lensing of MMI and Scott Smith of Cerulli highlight the key findings in the Q4 2024 edition of MMI-Cerulli Advisory Solutions Quarterly.

MMI-Cerulli Advisory Solutions Data Portal

Both the sponsor and asset manager dashboards on the MMI-Cerulli Advisory Solutions Data tab on Cerulli’s client portal have been updated with Q4 2024 data. As a reminder, MMI members that contribute their advisory solutions data to Cerulli on a quarterly basis have access to this online portal. It allows users to take a deeper dive into the MMI-Cerulli dataset – with the ability to sort, filter and export the data for business planning and presentation purposes.

Contact

With questions on the report, access to the online portal, or contributing data:

Email mmidata@cerulli.com

For assistance accessing the Advisory Solutions Quarterly report:

Email info@mminst.org