Managed Accounts Decline 0.2% in Q1 2025

- MMI-Cerulli Data

The newest edition of MMI-Cerulli Advisory Solutions Quarterly, with data through 3/31/2025, is now available for download.

Following strong performances in 2023 and 2024, U.S. equity market growth slowed in Q1 2025, as the S&P 500 declined more than 4% over the quarter. As a result of weaker market performance, managed account assets declined 0.2% for the quarter, falling to $13.7 trillion. Despite this drop, only rep as advisor (RA) programs decreased, as outflows outweighed inflows into client discretionary programs. Apart from ETF advisory programs (1.2%), which are growing from a small base, unified managed accounts (1.1%) and separately managed accounts (1.0%) experienced the strongest growth and the highest net flows of the quarter.

The relative strength of UMAs comes as firms continue to consolidate their disparate managed account programs into a unified chassis, and reflects the flexibility in vehicles, discretion, and tax optimization that UMAs offer. SMAs continue to garner attention due to their customization potential (e.g., tax optimization, security exclusion) as well as firms lowering the barriers to entry through fractional share use.

Direct Index assets near $900 billion at the close of 2024

This edition of Advisory Solutions Quarterly also examines the direct indexing landscape.

Direct indexing has been discussed at great length over the past several years, with wealth managers, asset managers, financial technology firms, and index providers all looking to attain a piece of the value chain. Despite the apparent popularity of the solution, as of 2024, just 18% of advisors report using direct indexing solutions. As advisor education continues and firms are increasingly able to accurately depict the additional tax alpha generated from these accounts, direct indexing is poised for continued growth.

It is important to note, however, that these strategies are not a one-size-fits-all solution. The advantages of ongoing tax optimization become more significant as a client's taxable holdings grow, and clients with smaller account sizes might see greater benefits in an ETF. Wealth management professionals and financial advisors must consistently evaluate their clients’ financial picture and recommend investment products that will best help them achieve their goals.

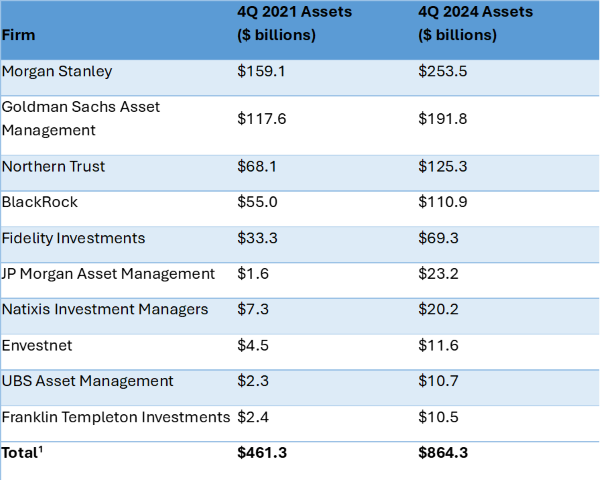

Direct Indexing Retail SMA Assets, 2021 vs. 2024

Existing direct indexing providers have grown rapidly over the past several years, and many more have entered the space.

Total $ in direct index assets as of Q4 2024. Total AUM could reach $1 trillion by the end of 2025.

¹Direct index totals include other firms

MMI-Cerulli Advisory Solutions Quarterly

Advisory Solutions Quarterly provides holistic analyses of the U.S. fee-based advisory industry, which includes sponsors (broker/dealer firms) that offer managed account programs and the asset managers that distribute those programs through their platforms.

MMI members can use this data to deepen their understanding of:

- Managed account program type assets and growth rates

- Quarterly managed account flows by program type

- Managed account sponsor firm assets at the program level

- Separate account manager assets at the trading discretion level

- Separate account asset classes in highest use by trading discretion type

Dive deeper into the report for insights in four key areas:

- Asset management distribution

- Long-term managed accounts industry trends

- Top-managed account program sponsors across all industry segments

- Asset allocation model portfolios

MMI-Cerulli Q1 2025 Advisory Solutions Quarterly Highlights

Joan Lensing of MMI and Scott Smith of Cerulli highlight the key findings in the Q1 2025 edition of MMI-Cerulli Advisory Solutions Quarterly.

MMI-Cerulli Advisory Solutions Data Portal

The sponsor and asset manager dashboards on the MMI-Cerulli Advisory Solutions Data portal on Cerulli’s Lodestar platform have been updated with the Q1 2025 data. The manager dashboards are expected to be updated the week of July 7th. As a reminder, MMI members that contribute their advisory solutions data to Cerulli on a quarterly basis have access to this online portal. It allows users to take a deeper dive into the MMI-Cerulli dataset – with the ability to sort, filter and export the data for business planning and presentation purposes.

Contact

With questions on the report, access to the online portal, or contributing data:

Email mmidata@cerulli.com

For assistance accessing the Advisory Solutions Quarterly report:

Email info@mminst.org